The insurance industry, much like the risks it seeks to cover, is in a constant state of flux. Among the many roles within the insurance ecosystem, Managing General Agents (MGAs) play a crucial part. They bridge the gap between insurers and customers, often specializing in niche markets or innovative products. However, as we pivot towards a new era marked by digital transformation and evolving customer expectations, it’s imperative for MGAs to modernize operations. At Accelerant, we’re championing this transition. Here’s a look at how MGAs can build for the future.

The Changing Landscape for MGAs

- Customer Expectations: Today’s customers expect quick, seamless, and digital interactions. Paperwork, long waits, and cumbersome processes are no longer acceptable.

- Data Deluge: With the proliferation of devices and digital touchpoints, there’s an overwhelming amount of data available. Harnessing this data effectively is a game-changer.

- Regulatory Dynamics: As risks evolve, so do regulations. MGAs must stay updated, ensuring compliance while also being agile enough to adapt.

Steps MGAs Can Take Towards Modernization

- Digital Transformation: Invest in digital platforms that can automate routine tasks, enhance customer experience, and streamline operations. This includes everything from policy issuance to claims management.

- Data Analytics: Implement tools and platforms that can sift through large datasets, deriving actionable insights to inform underwriting decisions, pricing strategies, and market trends.

- Collaborative Platforms: Foster collaboration by using technology that allow real-time communication and knowledge sharing among underwriters, brokers, and insurers.

- Cybersecurity: With increased digitization comes the challenge of cybersecurity. Ensure robust protective measures to safeguard sensitive data and maintain customer trust.

- Continuous Learning: The insurance landscape is dynamic. Investing in regular training and workshops ensures that the MGA team is always equipped with the latest knowledge and best practices.

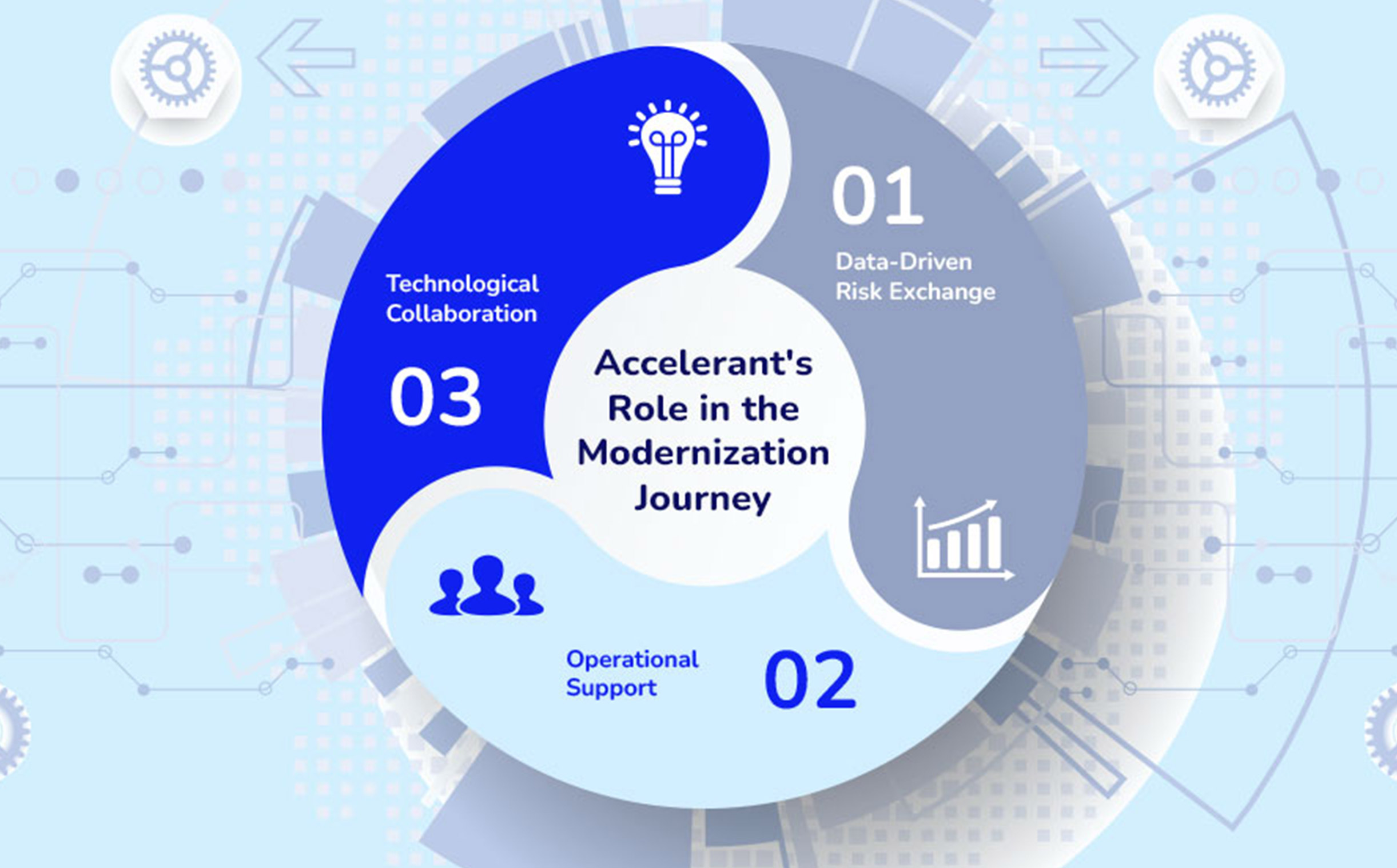

Accelerant’s Role in the Modernization Journey

At Accelerant, we’re not just observers; we’re enablers. Here’s how we’re assisting our Members in their modernization endeavors:

- Data-Driven Risk Exchange: Our platform provides our Members with a wealth of insights, helping them make informed decisions in real-time.

- Operational Support: From regulatory guidance to actuarial expertise, we offer a suite of services to ensure our Members can focus on what they do best.

- Technological Collaboration: By partnering with tech innovators, we ensure our Members have access to cutting-edge tools and platforms that drive efficiency and innovation.

Embracing the Future

While modernizing operations might seem daunting, it’s not just about technology. It’s about a mindset shift — a move towards being more responsive, agile, and customer-centric. The future of insurance is not just about covering risks but anticipating them. In this new era, MGAs that can adapt, innovate, and deliver will lead the way.

The call to modernize MGA operations is not just about staying relevant; it’s about thriving in a world of ever-evolving challenges and opportunities. We’re committed to ensuring that our Members are not just prepared for the future but are shaping it. Together, we will build, innovate, and redefine the possibilities of what MGAs can achieve.