Ask the Expert: Steve Strauss, Accelerant’s U.S. Chief Underwriting Officer

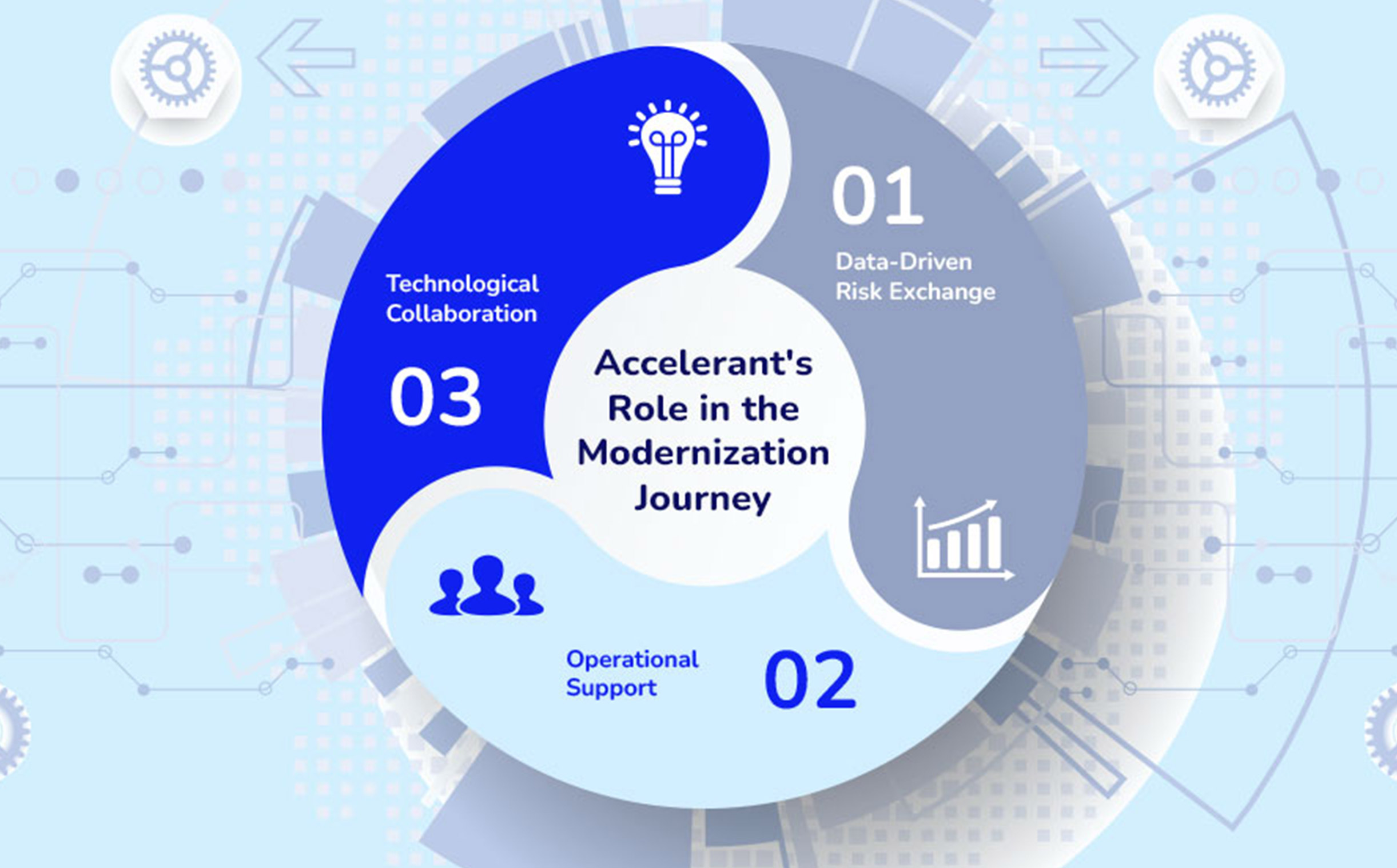

Steve Strauss brings nearly three decades of (re)insurance experience as Accelerant’s Chief Underwriting Officer for the U.S. region. Over the course of his career, Steve was Vice President of CNA Reinsurance, Vice President of Business Development at Berkley Program Specialists, Senior Vice President and Deputy Team Leader of U.S. Casualty at SCOR, and Chief Underwriting … Read more